RecargaPay received license from the Central Bank of Brazil to open a SCD

With the approval, the company will be able to expand its microcredit offer

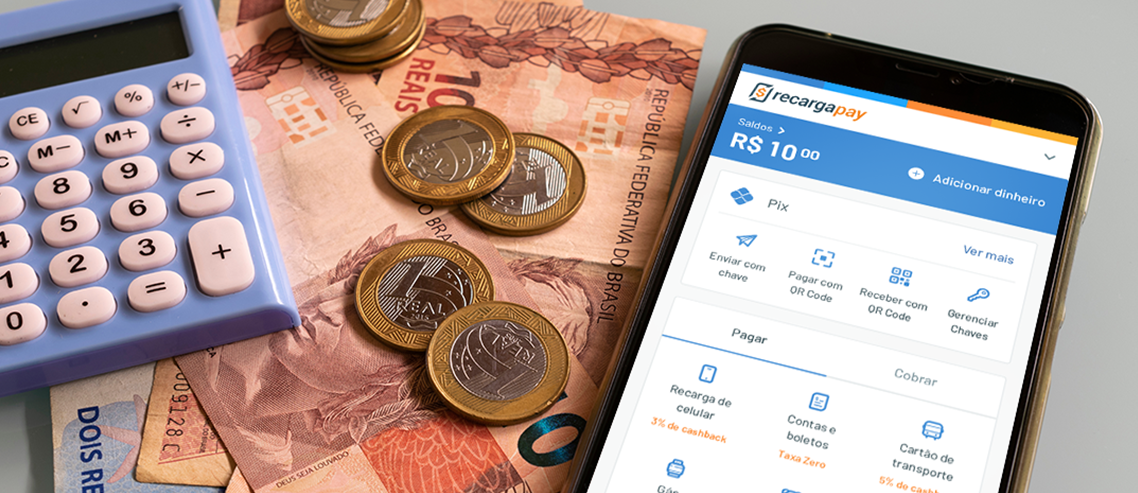

RecargaPay, an app specialized in payments and financial services, received authorization from the Central Bank of Brazil to constitute its SCD (Direct Credit Society). With the license, the fintech gains more autonomy and thus intends to expand its credit offer to help more and more Brazilians with their payments.

According to Gustavo Victorica, co-founder and COO of RecargaPay, “the license granted by the Central Bank reinforces the maturity of our business and our commitment to develop a strong and reliable product, and demonstrates the robustness of RecargaPay’s performance over the past years”.

Founded in 2010, RecargaPay’s mission is to democratize mobile payments, and since then it has been developing what has become one of the largest payment ecosystems in Brazil. Focusing on convenience, security and accessibility, the app offers different financial services, from transfers via Pix, to buying cooking gas or applying for microcredit – this last service, available on the app for four years now through partners.

Investing in the loan market, in August RecargaPay debuted in the debt market with a R$ 40 million debenture. With a proprietary analysis methodology, the company evaluate, among other factors, the customer behavior within its application to intermediate the loan, facilitating customers’ access to credit.

“Our expectation is to improve the credit offer so that it is always aligned with our customers’ needs. We understand that RecargaPay must act as a facilitator in people’s financial lives, and the license helps us deliver even better services,” Victorica adds.